The Committee for Competition Development and Consumer Rights Protection has approved the acquisition of a 100% stake in Chorsu Real-Estate Development by the Emirati Ittihad Investment Central Asia Holding Ltd, as reported by the agency's press service.

Ittihad Investment Central Asia Holding Ltd is a specialized holding company established in 2008, focused on investment activities. Since its inception, the investment fund has invested in more than 20 portfolio companies worldwide. In 2023, the company's turnover reached $2.8 billion, with exports amounting to $2 billion and investments totaling $1.4 billion.

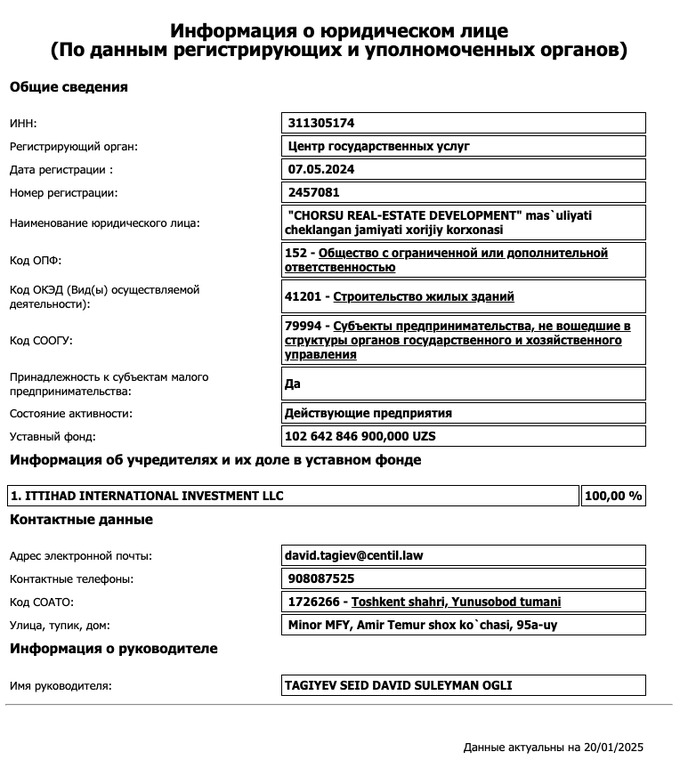

Following a thorough review, the special commission concluded that the economic concentration would not impact competition in the market, thus approving the deal. According to the Unified State Register of Legal Entities, the founder of the developer is an Emirati company.

Chorsu Real-Estate Development was founded in May 2024. Its charter capital is 102.6 billion sums, with the primary activity being the construction of residential buildings. The director of the company is Tagiev Seid David Suleyman ogli, a partner at the Centil law firm.

In 2020, Ittihad International Investment purchased the Chorsu hotel building for 16.9 billion sums at an open auction.

The buyer committed to investing at least $25 million within two years, creating 150 jobs, and ensuring the hotel operates at a minimum three-star level.

Under the terms of the deal, the hotel must remain operational for at least 10 years. In the event of the building's demolition, the new project must adhere to the original design.

Additionally, in January 2025, the investment company signed an agreement for the implementation of a significant PPP project in the healthcare sector worth $70 million. The first phase aims to equip all 14 district medical associations in the Fergana region with multi-slice computed tomography (MSCT) scanners. Following that, 86 more devices will be procured for medical institutions in other regions.

Subsequently, specialized reading centers will be established in each region to analyze tomographic images from districts and cities. The agreement will also include training specialists to work with MSCT.

Previously, Spot reported that the Competition Committee approved concentration deals worth 18 trillion sums.